Posted: 7th April 2021, Updated: 6th Feb 2025UK Landfill Tax to Rise to £126.15 from 1st April 2025

Landfill Tax prices for the standard and lower rates see yearly increases at the beginning of April. The government implemented this year's increases on 1st April 2025.

What is Landfill Tax?

Landfill Tax is an environmental tax paid on top of landfill rates by any company, local authority or organisation that tips waste at a licenced landfill site. The government introduced the tax to encourage alternative waste disposal methods, such as recycling and more sustainable practices in the waste hierarchy.

The tax on waste disposed of at landfill sites is set at a fixed amount per tonne, and the high prices reflect the environmental cost of not recycling. Prices are updated yearly at the start of April, and the trend shows that the price increases show no sign of slowing down.

What are the new Landfill Tax rates from 1st April 2025?

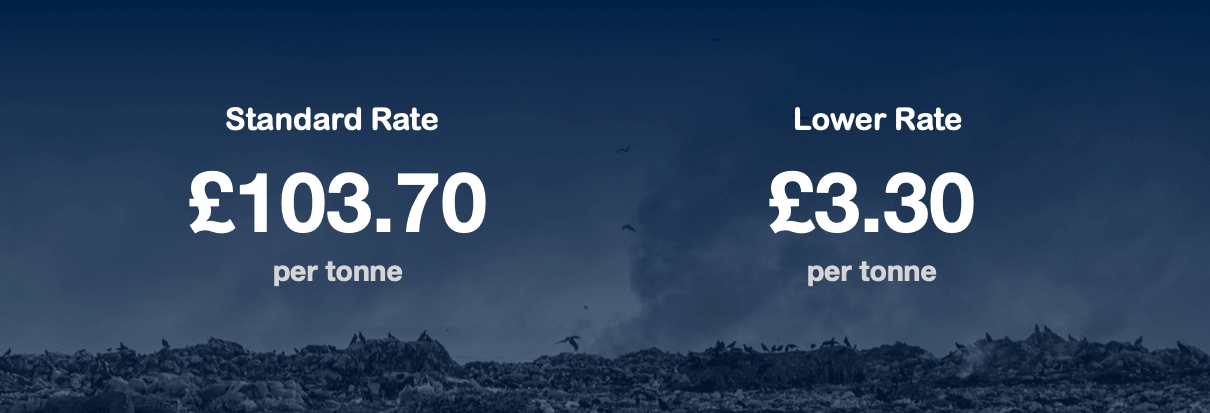

Landfill Tax operates at two rates: a standard rate for active waste, which includes most household and commercial waste and a lower rate for inert materials.

See below the UK Landfill Tax rates increases from 1st April 2025. The amount shown in the table below is per tonne of waste disposed of at landfill sites.

| Rate | Tax (per tonne) |

|---|

| Standard Rate | £126.15 |

| Lower Rate | £4.05 |

* Inert or inactive waste (such as rocks or soil) is subject to the lower rate.

Could your business be recycling more?

Businesses are subject to continually increasing Landfill Tax prices. It is crucial to ensure you are getting the best recycling rates possible. At ISM Waste & Recycling, we recycle over 90% of the waste that we collect. Please contact us to speak to one of our expert team members about our recycling-led waste management services. We cover all areas across Greater Manchester and Lancashire including, Bury, Bolton, Manchester, Oldham, Blackburn and Rossendale.

Useful Links:

Was this article helpful? Share it on social media.